- MSME Financing

- Grow Fearlessly with FynX MSME Financing

Limited cash flow and access to working capital are hurdles every MSME faces. At FynX, we understand. That’s why we offer tailored collateral-free MSME Financing solutions to empower your business dreams.

We look beyond collateral, evaluating your business’s creditworthiness, income stability and repayment history. Optimize your cash flows and grow your business exponentially.

- FynX Accounts Receivables

Unlock the potential tied up in your outstanding invoices. Convert the loan to immediate working capital and free up cash for vital operations and investments.

- FynX Accounts Payables

Manage your supplier payments strategically. The loan provides you with temporary credit to bridge the gap between your purchase orders and payment deadlines, so you can maintain strong supplier relationships and negotiate better terms.

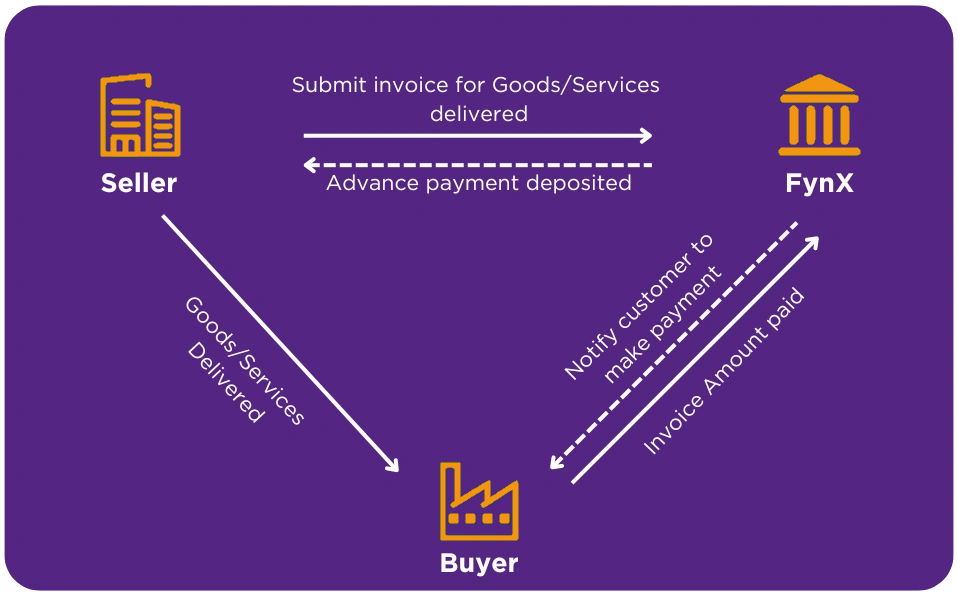

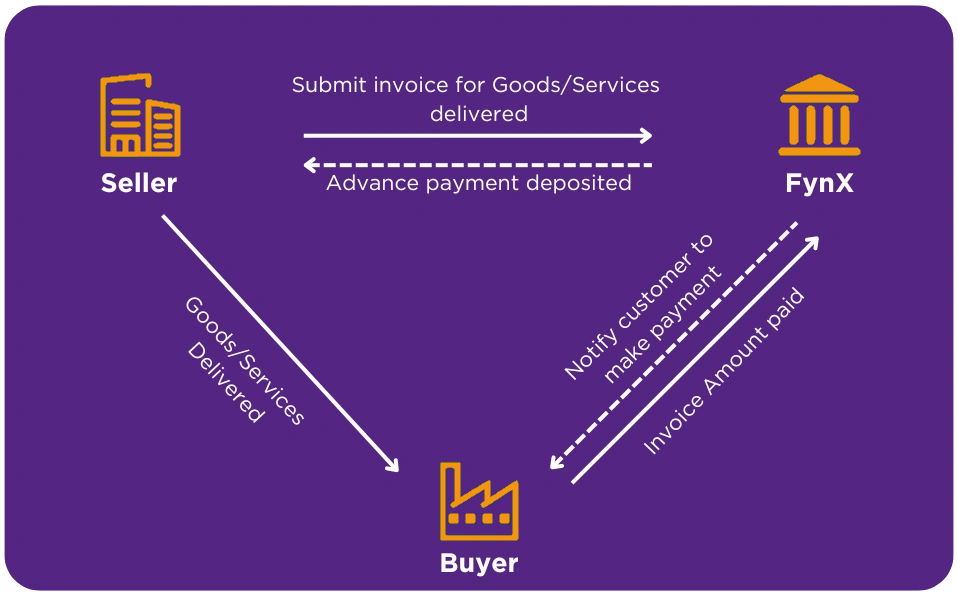

- FynX Supply Chain Financing

Enhance your operations with improved liquidity, particularly in managing cash flow within your supply chain. FynX’s Supply Chain Financing releases trapped capital in your invoices, enabling you to concentrate on what truly matters – running your business.

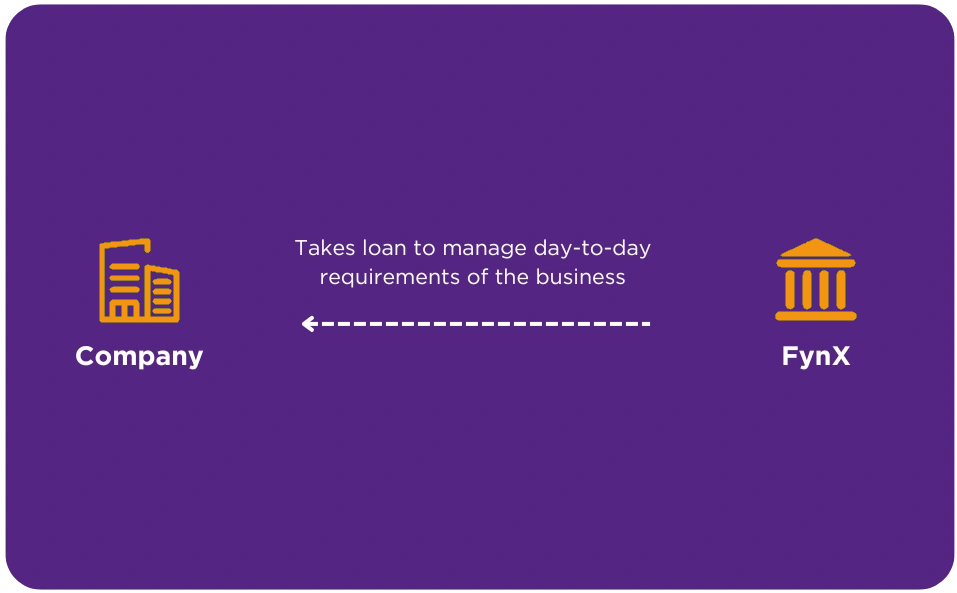

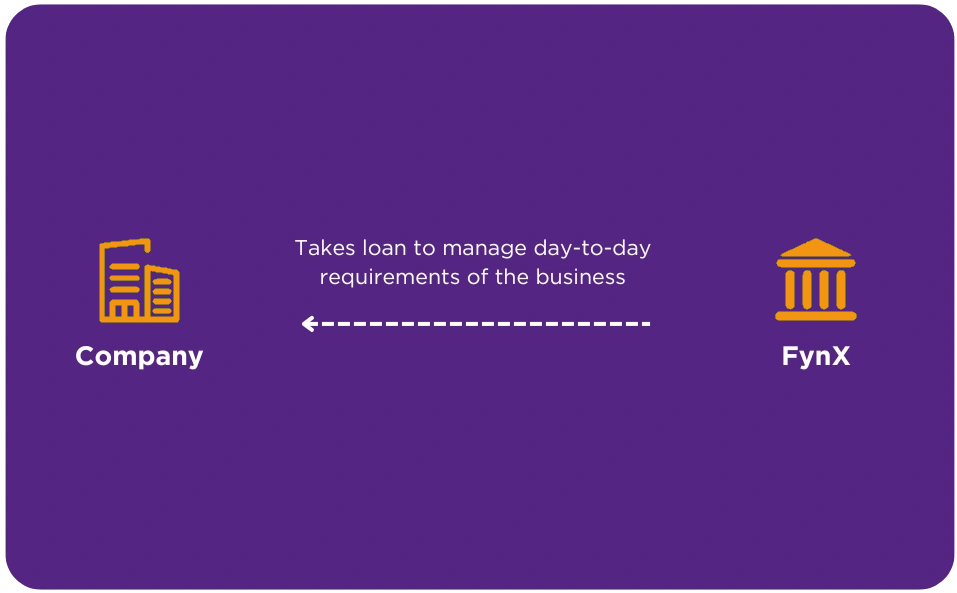

- FynX Working Capital Finance

Delays in customer payments, fluctuating inventory needs, and unexpected expenses can disrupt smooth operations. Our flexible Working Capital solutions provide the financial boost you need to bridge these gaps and keep your business moving forward.

- Features

Flexible Loans

We offer adjustable repayment terms and structures, accommodating varying cash flow needs and business cycles.

Financialization

We bring more people into the formal financial system by expanding their access to financial products and services.

Fast Funding

Rapid access to funds ensures smoother cash flow management, allowing businesses to meet immediate financial obligations.

Fair Rates

Our rates ensure that loans remain accessible to a wider range of borrowers fostering inclusive financial growth.

Facile Experience

We leverage advanced technology and digital platforms to automate processes and approvals, minimizing paperwork and reducing time.